|

20 February 2017

Posted in

Special research

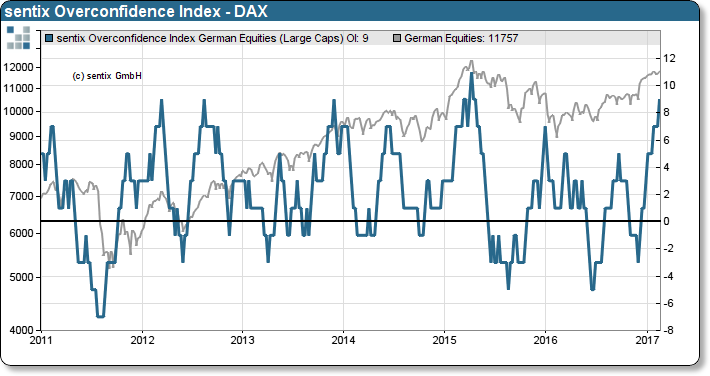

The latest sentix survey reveals an issue: the sentix Overconfidence Index for the German Stock Index DAX has reached a new two-year high. Hence, the indicator signalises that investors have gained an extreme conviction that the market is trending upwards. A historical comparison indicates that the market has accumulated substantial risk.

A look back into market history reveals that we have only witnessed a sentix Overconfidence Index (OCI) level of at least +9 points only a few times in the recent years. Nevertheless, after each sign of overconfidence, the market was ripe for a significant correction. The DAX lost on average 3.7% within 12 weeks following such an OCI. Investors should take this indication serious as the Strategic Bias of the DAX (the level of confidence in German stocks) continues to retreat at the same time.

Background

The sentix Overconfidence Index (OCI) shows how probable it is at a given point in time that price behaviour in a market is perceived by investors as a trend. The higher this probability, the stronger the case for investors becoming overconfident regarding their forecasting skills. In a situation of overconfidence the likelihood, in turn, rises for a price movement against the trend as investors tend to accumulate extreme positions.

The sentix Overconfidence Index can fluctuate between -13 and +13 points. Readings below -7 or above +7 indicate a high probability of investors being in an active trend-perception phase and, thus, for a relatively large degree of complacency and overconfidence. The potential for a price movement against the trend then depends on the already accumulated investors’ positions.

The current sentix survey ran from 16-February to 18-February-2017, and 1.113 retail and institutional investors took part in it.