|

12 June 2017

Posted in

Special research

In the last few days, political news on both sides of the Atlantic has dominated the day. However, only a part of the investors was concerned. Thus, the attitude to Brexit hardly changed, still the investors see a moderate burden on the stock market perspectives. Macron's election victory, on the other hand, was priced in and investors said they did not want to react to it. The excitement, however, is Trump, which is becoming more and more a problem for the markets.

In the sentix policy barometer, which describes the medium-term impact of individual policy areas on the stock market from the investor's point of view, the election in the UK did not change the Brexit expectations. Still, the investors surveyed by sentix see a moderate negative impact on the markets. Geopolitical risks have become much more important. The sub index has fallen from -0.46 to -0.61 (scale -2 to +2). Overall, investors regard the policy as a moderate burden.

| Date | Brexit | Elections | Geopolitics | Grexit | Politics Overall | Trump |

| 14.04.2017 | -0.38 | 0.00 | -0.67 | -0.45 | -0.46 | -0.51 |

| 12.05.2017 | -0.36 | 0.04 | -0.46 | -0.26 | -0.08 | -0.46 |

| 09.06.2017 | -0.34 | -0.01 | -0.61 | -0.28 | -0.30 | -0.67 |

Indices of the sentix policy barometer

As can be seen from the above table, the US President and his policy are judged to be much more negative. For this purpose, we carried out a detailed investigation.

The Senate hearing of the former FBI boss Comey has again investors' view of the "remaining time in office" of the US president shortened. On average, investors expect Trump to stay in office for only 3.5 years. Less than 10% of investors expect the US president to get re-elected and stay the second- term successfully in office.

But it was not just the allegations surrounding the hearing, which led to this assessment. On the contrary, even the policy areas on which investor hopes at the beginning of the year were based are now being judged worse. Trumps' consent values are accordingly catastrophic on a professional and personal level. Professional approval has fallen from -0.71 to -1.2 points (scale -2 to +2) since the start of the company, while the weak personal skills slipped from -1.2 to -1.48.

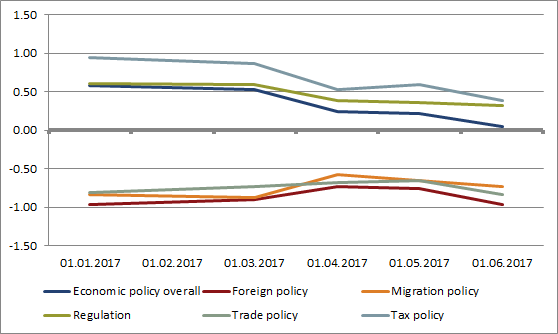

Development in important fields of competence of US policy

If investors' perceptions and losses of trust spread in the US population, this could pose a threat to the US recovery. The latter had once again received a "second air" through an improvement in the consumer mood. That such downside risks exist was underlined last week by the sentix economic indices for the US.

[slides=Background|grey}

The sentix policy barometer is conducted monthly in the second week of the month. It is intended to show whether and which policy issues from the investor's point of view are decisive for the capital market developments. In addition, we looked at the policy of the current US administration precisely from the current occasion.

The current survey was conducted between June 8th and June 10th, 2017, among some 1.100 private and institutional investors.

{/slides}